of quality parts

Features

/customfabricator

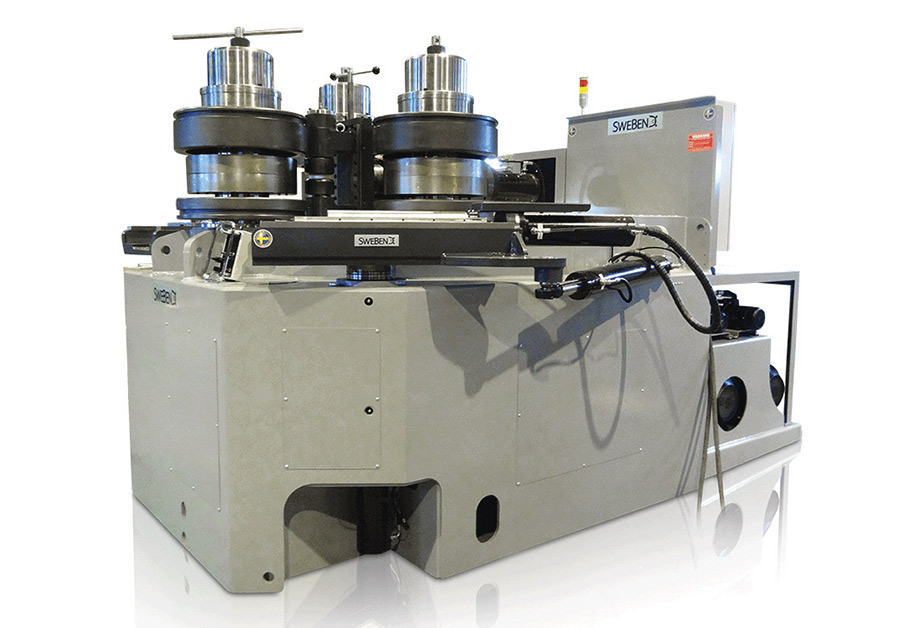

/bending

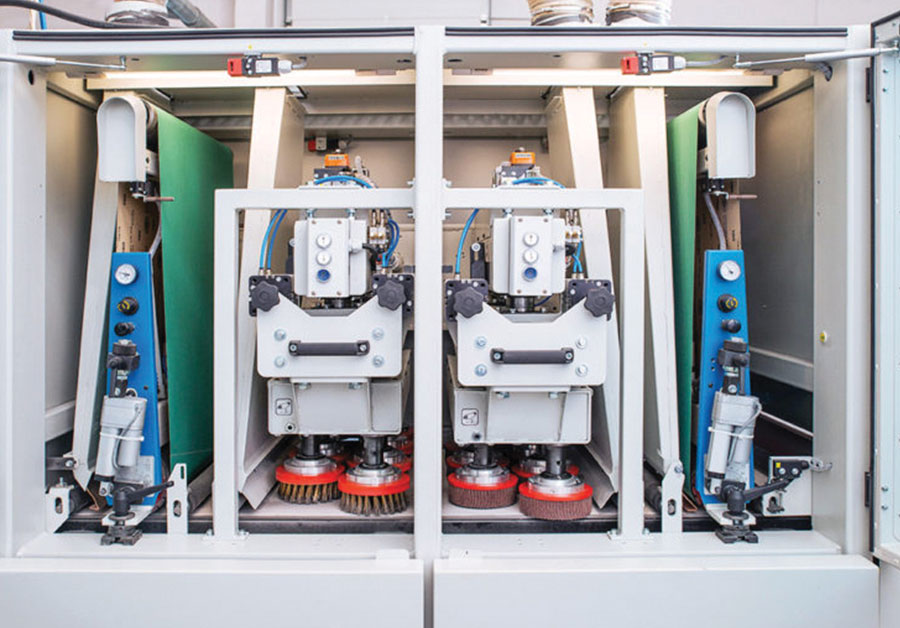

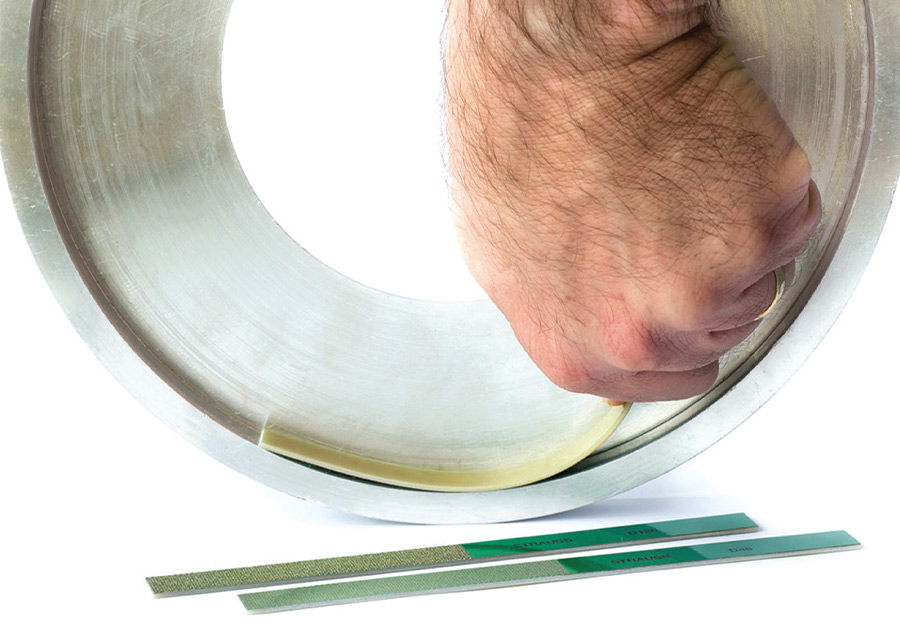

/deburring

Learn more

From the

Senior Editor

he procession of gloom is endless. Every day, the television news and newspaper front pages report heart-wrenching stories of people out of work, of staggering unemployment statistics. The pandemic-fed fall in the economy has affected people that are seemingly immune to hard times. Not unnoticed are the bizarre images of families queueing up for free food boxes in their Mercedes-Benz or BMW SUVs.

And yet, there is the sense that a turnaround is in the offing. Current national unemployment is in the 10-percent range, a considerable improvement from just a month ago. Congress is wrestling over another financial stimulus, with some factions claiming that more stimulus money is a disincentive to work. But recent studies by both Yale University and the University of Chicago have shown that this is not the case, and people receiving stimulus payments are still in the job market. Americans, by and large, are spending on basics and necessities, delaying discretionary purchases and accumulating cash.

ack in March, companies scrambled to comply with ever-changing safety guidelines to remain operational. As time has passed, social distancing efforts, sanitation upgrades and remote work access have become part of day-to-day business. The production line must remain on site in order to fulfill orders but staggered schedules or crew number limitations are not sustainable without a long-term plan.

In addition to distancing work stations, adjusting schedules and providing workers with work station shields and proper air filtration, it is imperative for everyone inside the facility to wear masks, carry out symptom checks and institute a no-questions-asked paid sick day policy.

People are struggling to make ends meet. Throughout the U.S., a lot of people already have lost their jobs. If you are forced to choose between going to work or risk being fired because you’re asking for sick time, that is not an effective way to keep the virus from spreading or to remain a productive business.

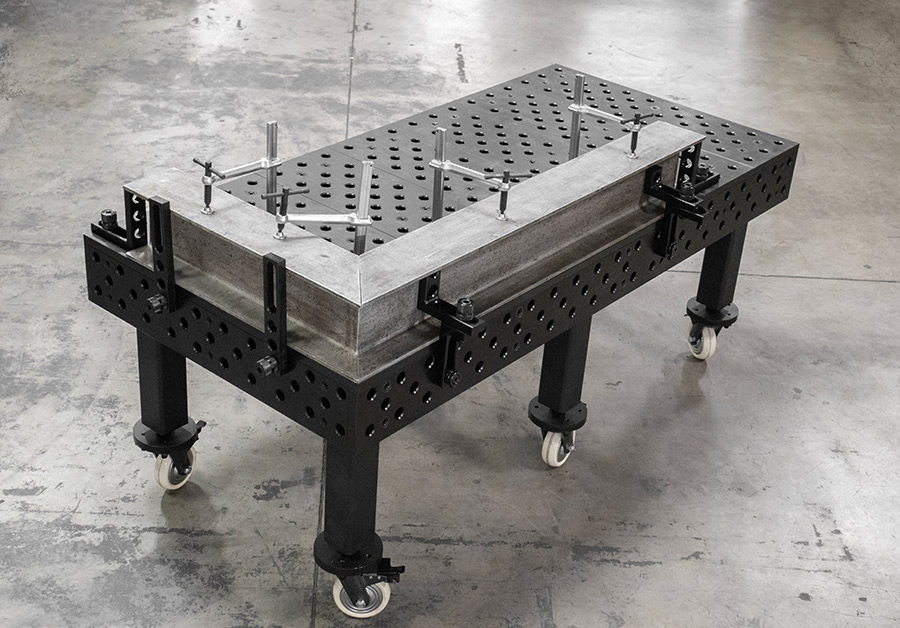

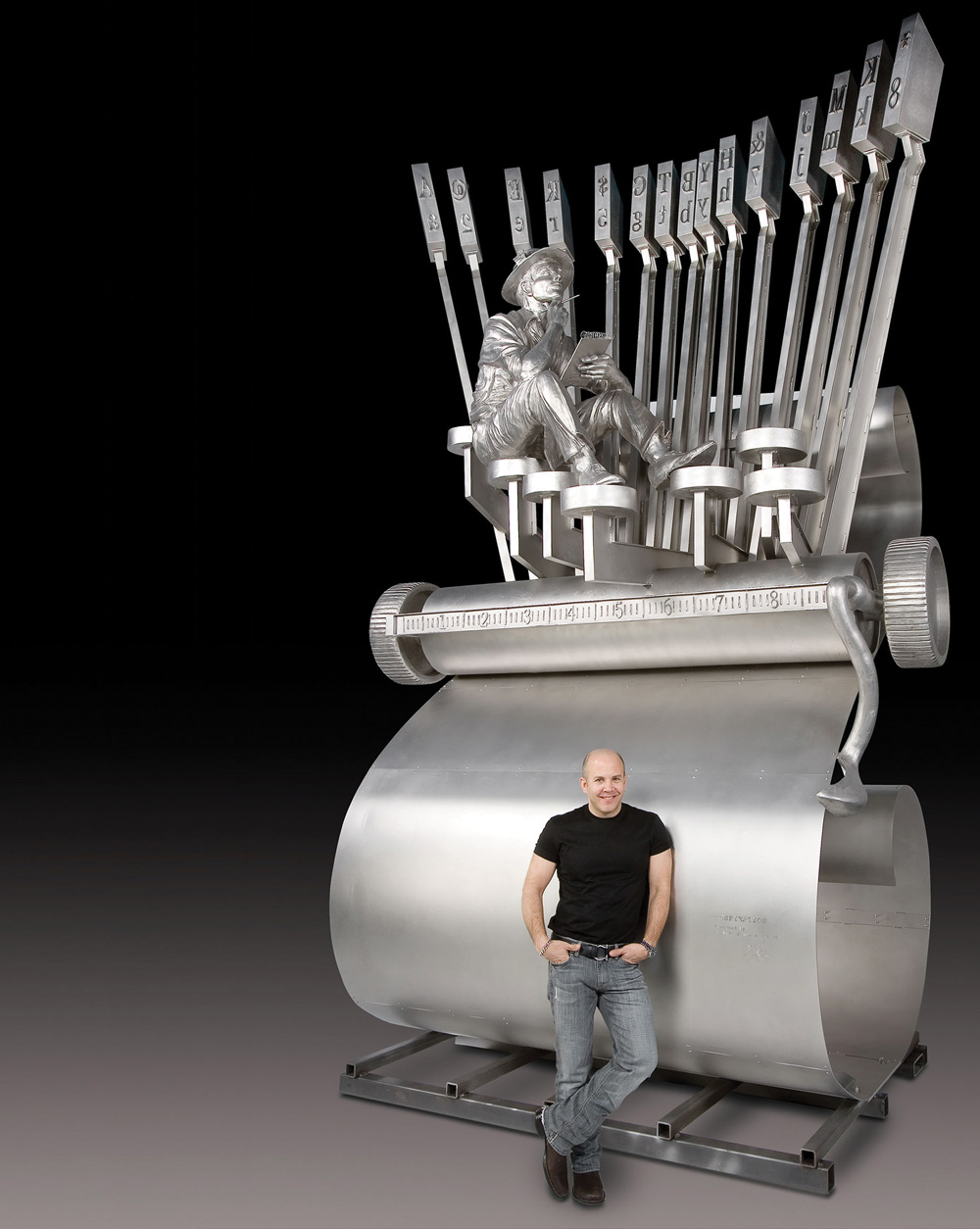

FOR OVER 40 YEARS, WB Indus-tries has manufactured custom machined and metal fabricated parts, tooling and equipment for a wide variety of industries, applying customer-specific requirements and working to several industry standards, such as NASA, Boeing, AMS, AISC, IBC, ASTM and MIL.

“We build things that solve certain logistic problems—equipment designed with the goal of moving things from one place to another effectively,” says Gary Bertolucci, president of the O’Fallon, Missouri-based fabricator.

Marc Glasser

Rolled Alloys director joins HTS board

The Heat Treating Society re-elected Marc Glasser, Rolled Alloys’ director of metallurgical services, to its board. He will now serve through 2023. Glasser has been with Rolled Alloys since 2012 and has nearly 40 years of experience working in materials science and engineering.

Bystronic adds sales engineer

Zack Morrison has joined Bystronic Inc., Hoffman Estates, Illinois, as a direct sales engineer for the Oklahoma and Kansas territories. He has over 10 years of direct manufacturing industry experience in sales management and CNC production and the skills of a consulting engineer.

Photo: National Corvette Museum

or at least 20 years, aficionados of the Chevrolet Corvette have speculated on the possibility of the car evolving from a front-engine configuration to mid-engine. Almost all of Europe’s supercars have the engine mounted behind the seats. With the the exception of a few one-off efforts, Corvette was the American holdout.

Speculate no more. For its eighth generation, the Corvette does indeed introduce the much-anticipated and long-awaited mid-engine design. The C8 Stingray is a total break from a 67-year front-engine tradition, now putting it in league with Ferrari, Lamborghini, McLaren, Lotus and many of the other European cars that appear on teenage boys’ posters.

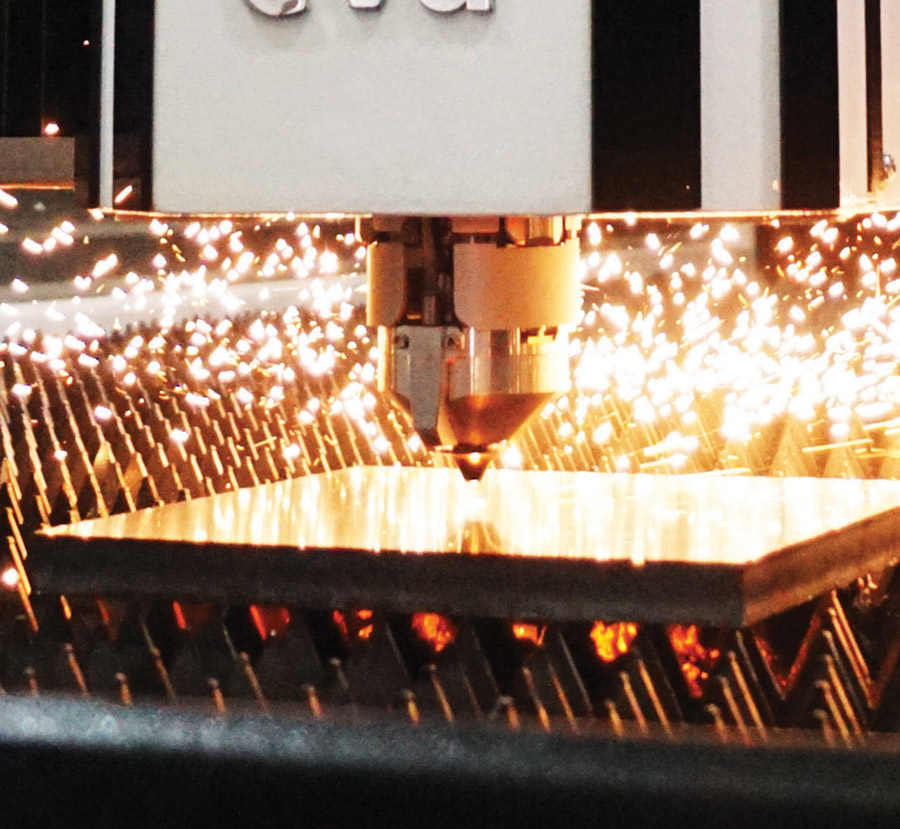

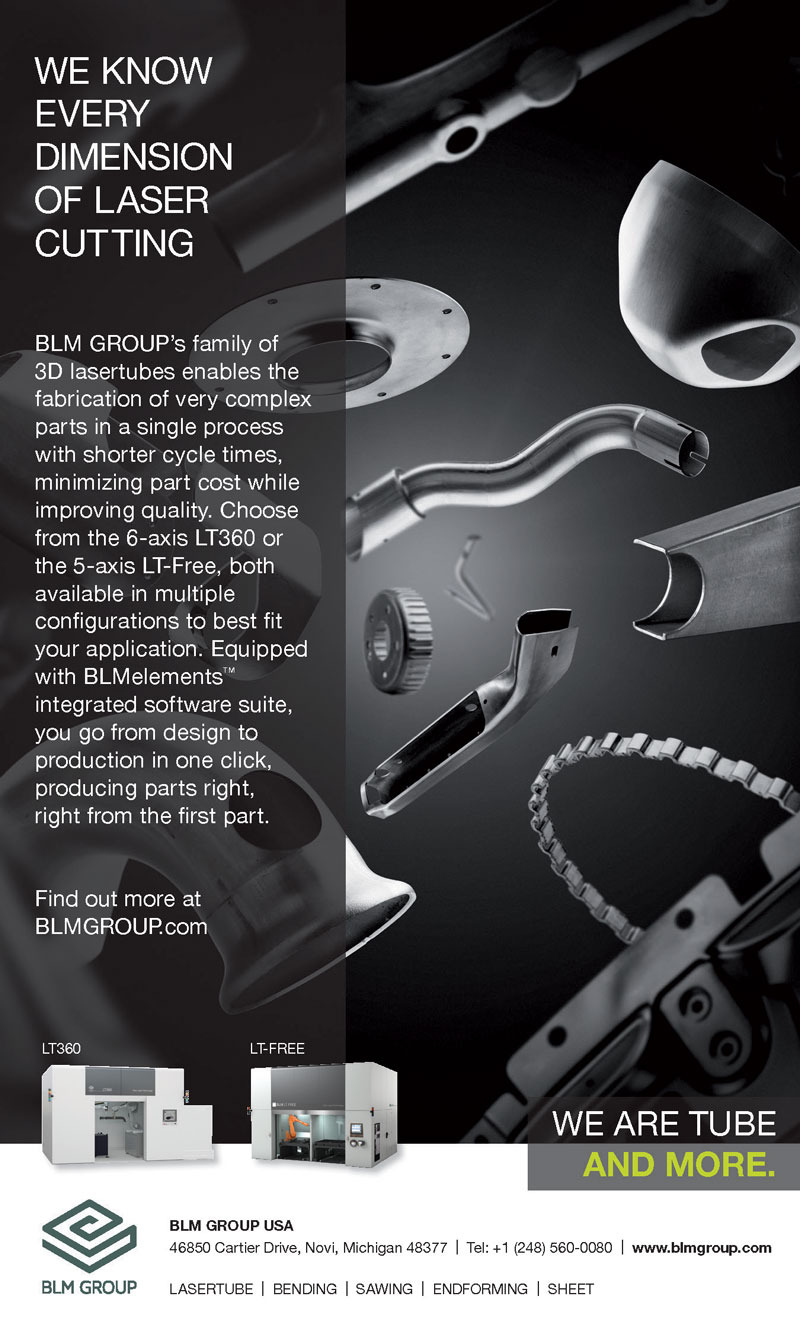

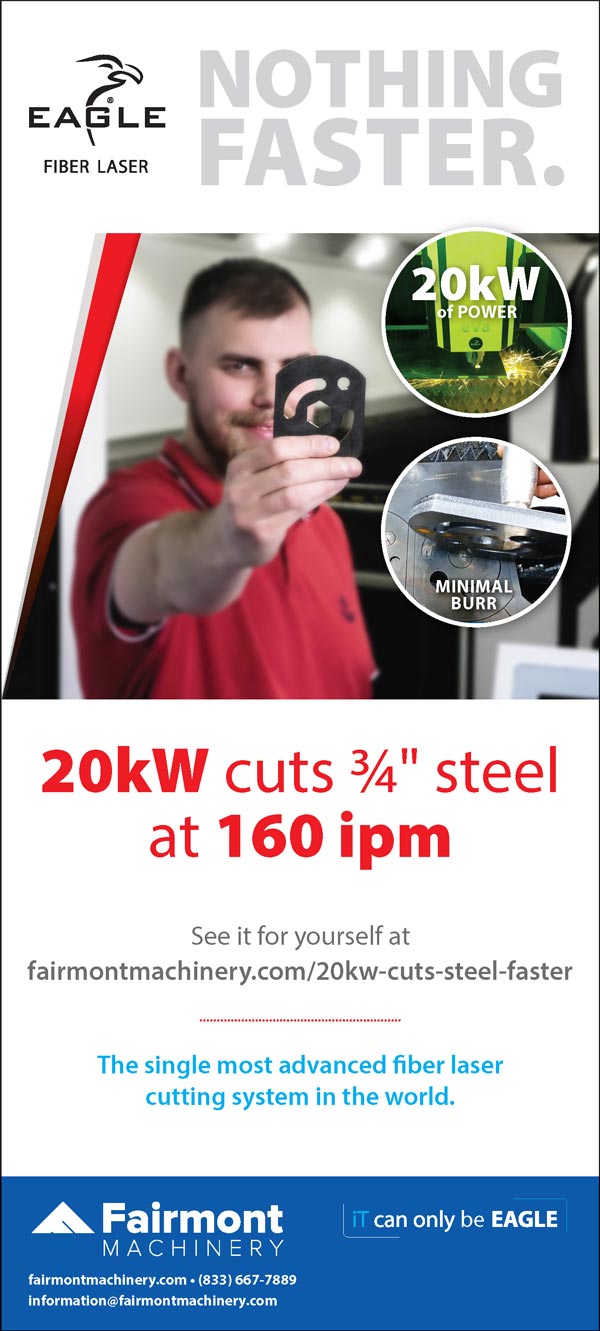

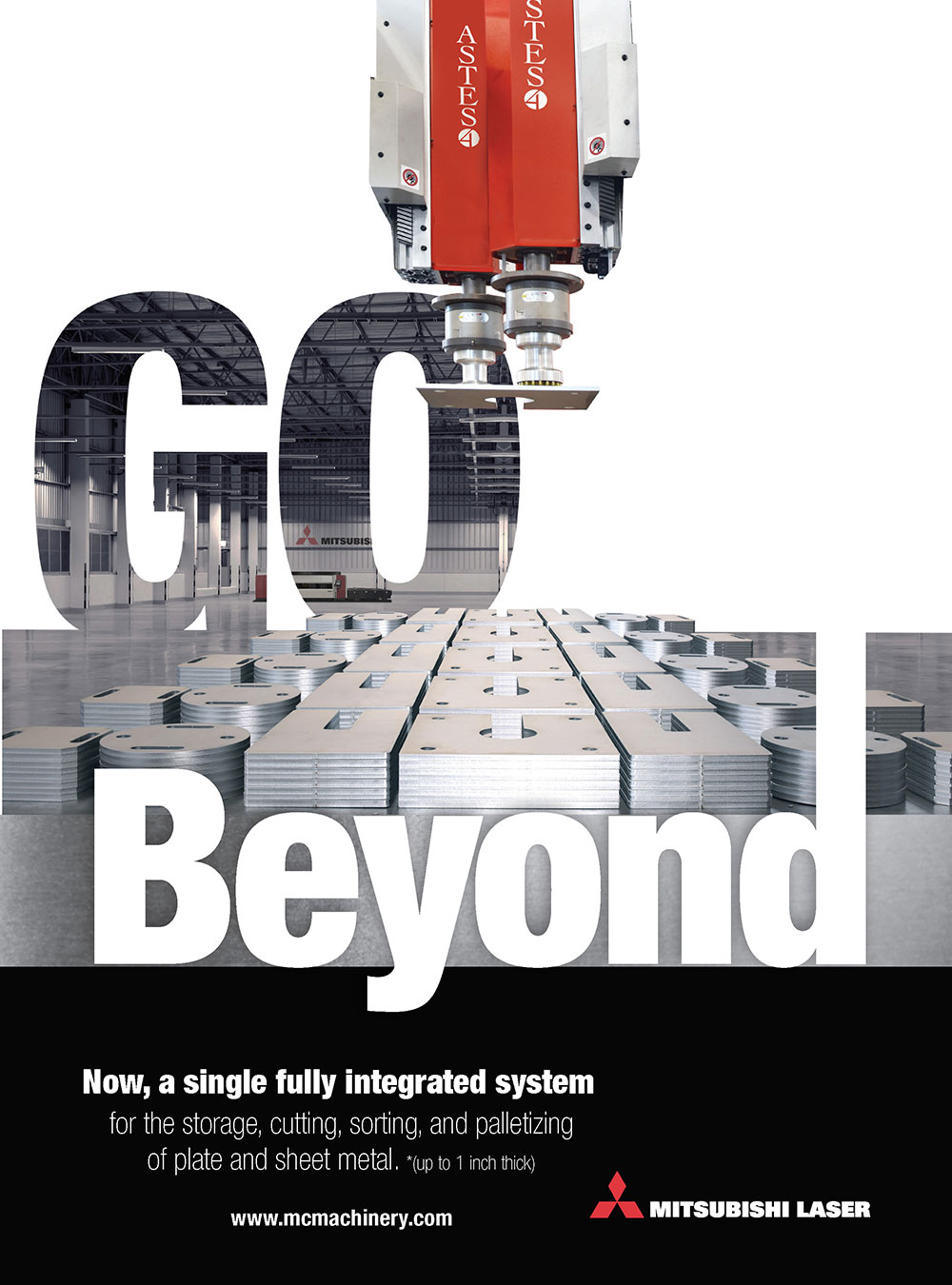

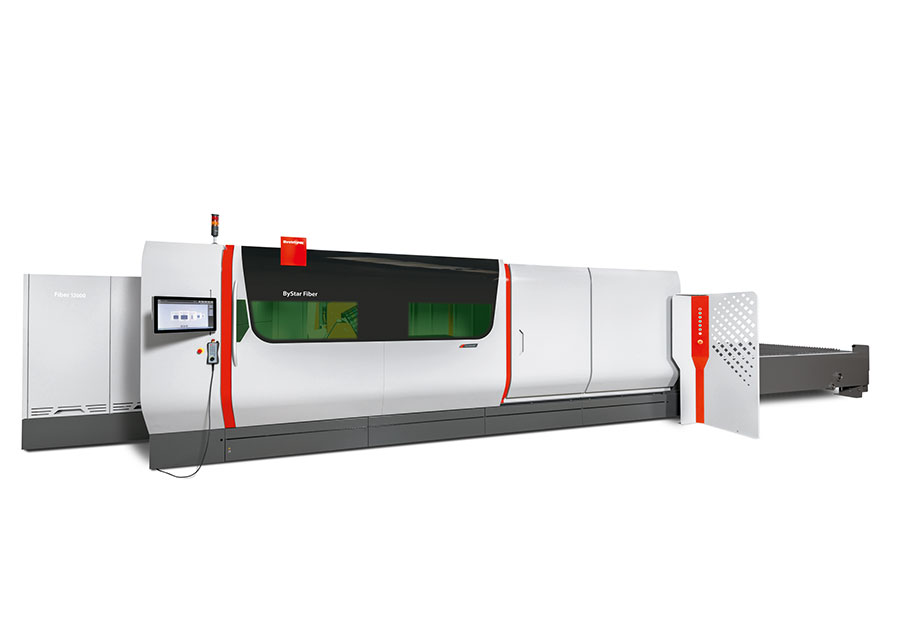

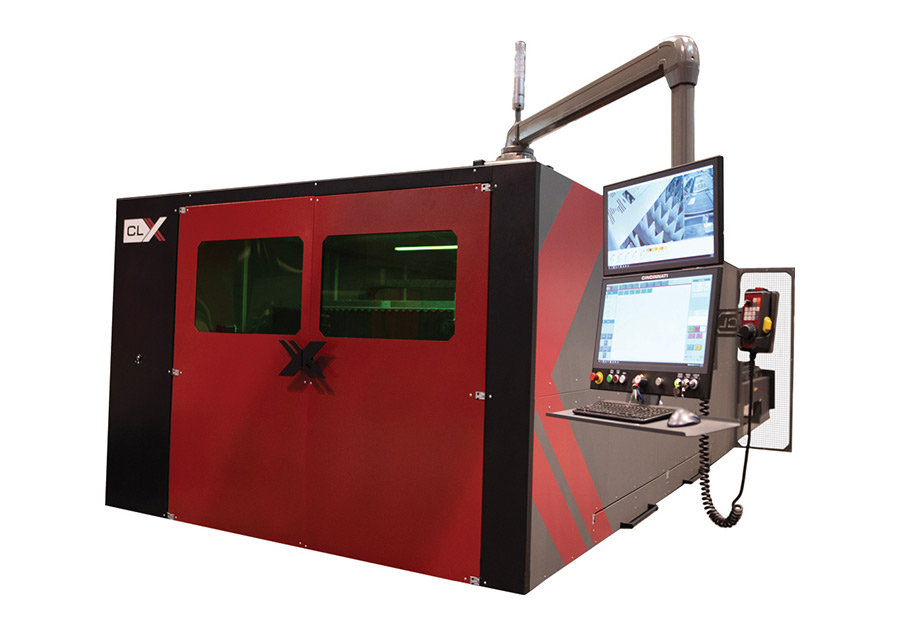

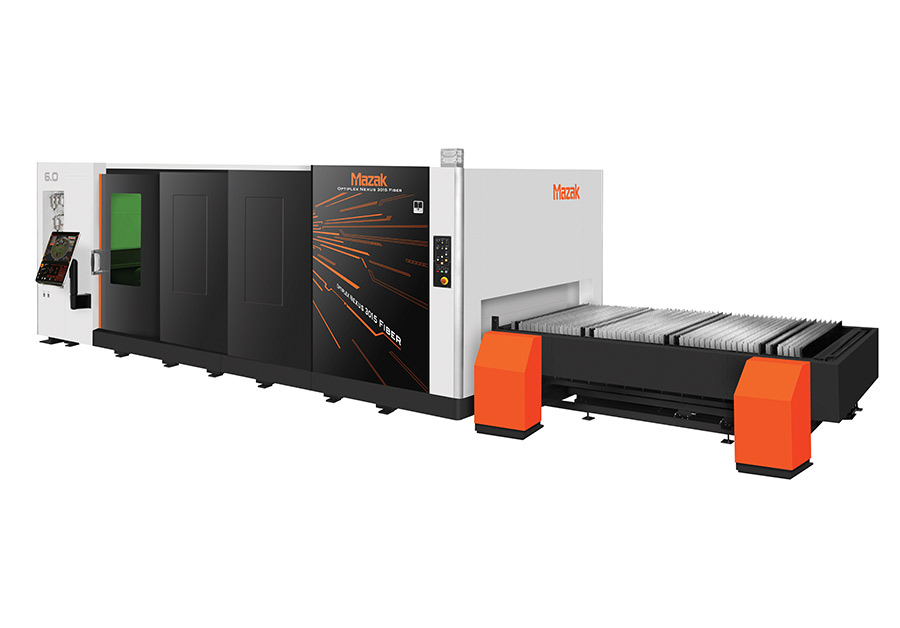

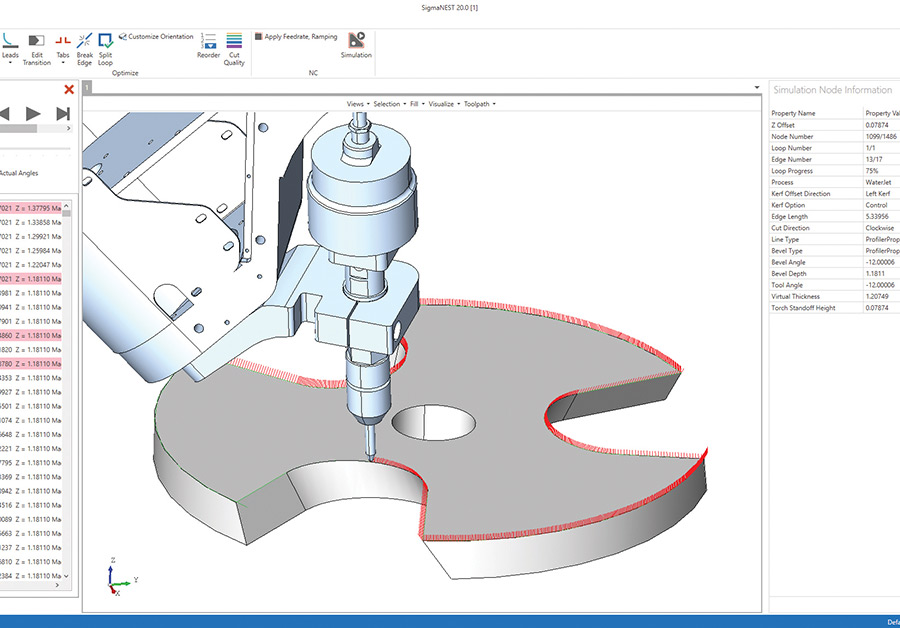

here’s a movement afoot in North America that is driving the development of higher wattage fiber lasers. According to Chip Burnham, co-owner of Fairmont Machinery, the reasons are simple. Higher wattage machines can produce cheaper parts faster. But there is a catch.

“Eight years ago, 4 kW fiber lasers were common,” Burnham says. “Capacity for power quickly escalated to 6 kW and 8 kW. Today, manufacturers are pushing for machines that can deliver 10 kW and higher. The trick lies with the cutting head. OEMs are struggling to develop a laser delivery system, such as cutting head optics, that can withstand more power without experiencing failure. Replacement or rebuild costs can be hefty, ranging from $8,000 up to $40,000.”

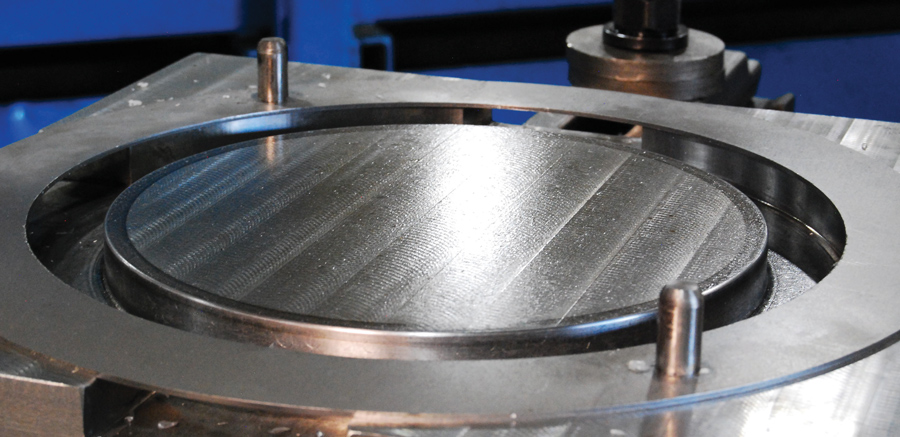

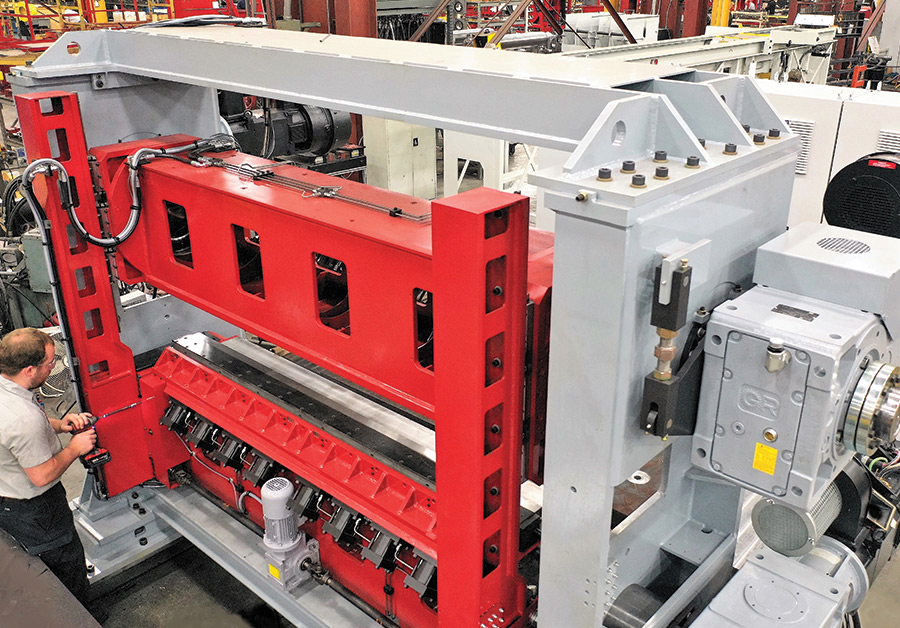

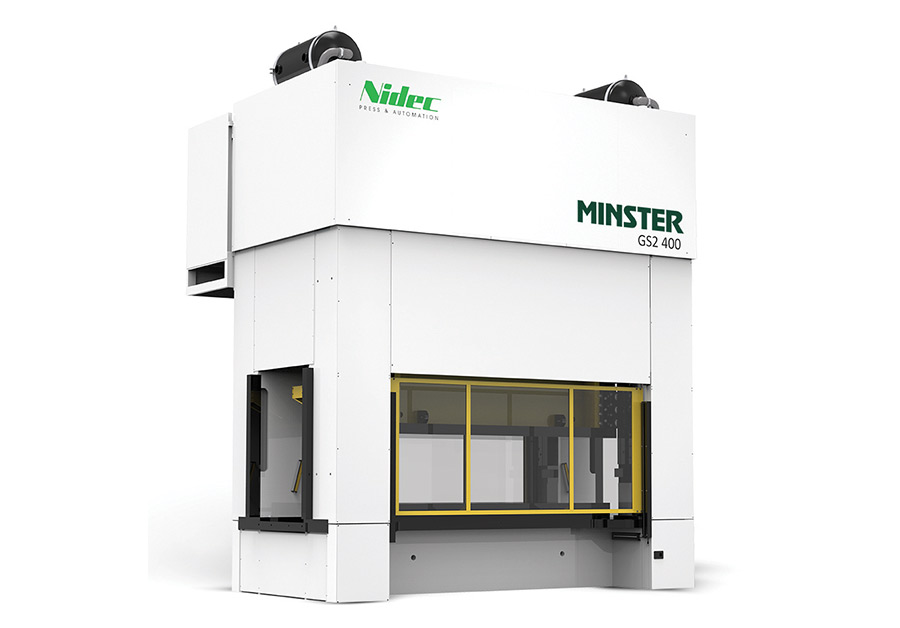

ith a collection of presses ranging from a 15-ton mechanical press to a 600-ton hydraulic press, Synergy Prototype Stamping LLC can take on an order for a single part or 100,000 units. For customers in search of sources for low-volume production, it can be difficult to find companies that won’t charge high prototype piece prices or huge tooling expenses seen for high-volume jobs.

A manufacturer of aftermarket off-road vehicle parts turned to Synergy to manage parts from start to finish. “We can buy turnkey with finished weldments, fully coated and inspected and ready for our final packaging. That saves us time and additional management on our end,” says an engineering product manager at an off-road aftermarket vehicle part manufacturer.

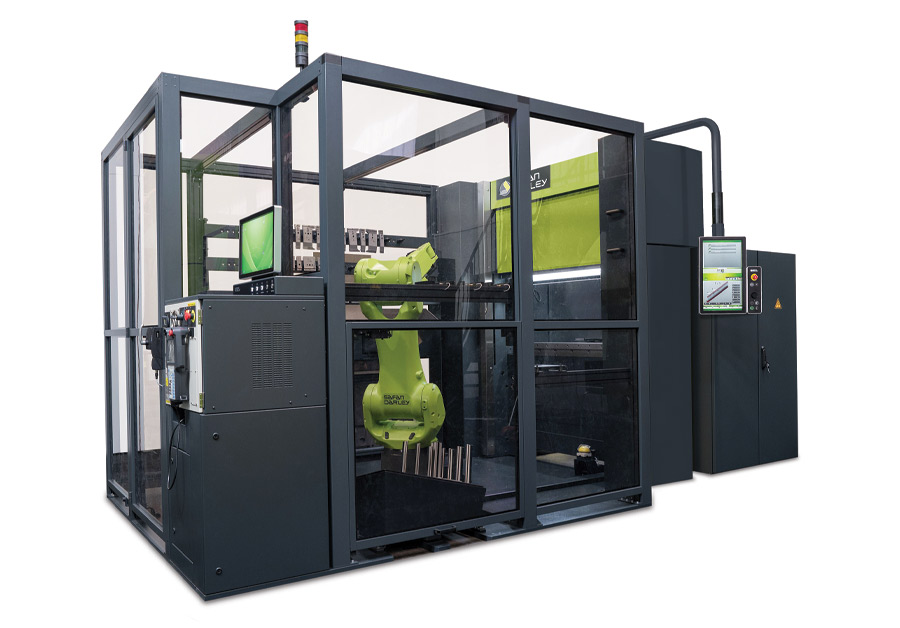

he American Welding Society predicts the U.S. could see a shortage of 400,000 skilled welders by 2024. Older welders are reaching retirement age at a high rate while younger welders are not filling the gap fast enough. Experts suggest a couple courses of action to help solve the problem.

First, companies need to do more to entice younger people to consider the trades as an option to a four-year college education. Secondly, manufacturers and fabricators should look more closely at the latest advanced automation. FIM opted for the latter.

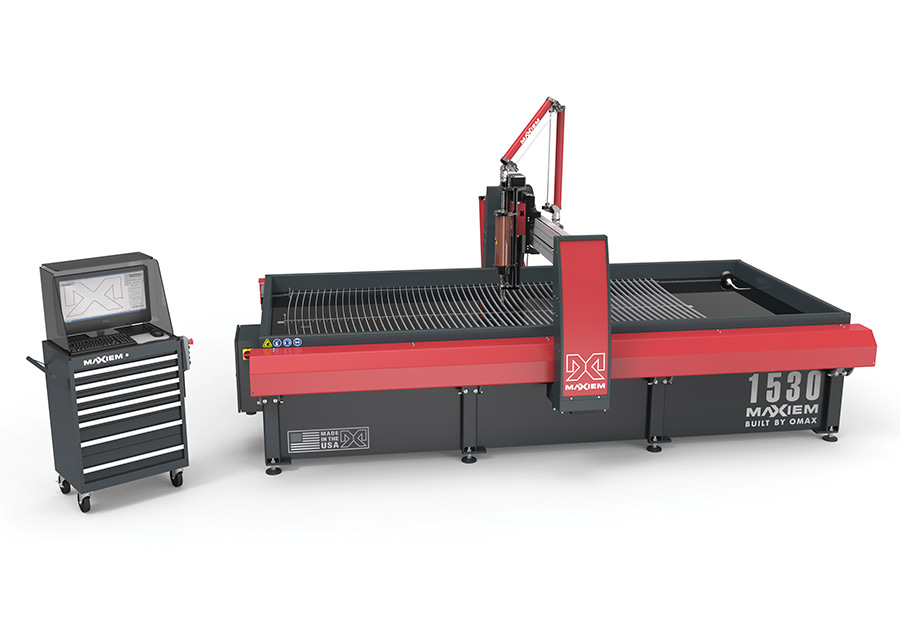

hen lead times ballooned from two days to more than two weeks, Ergonomic Solutions Inc. (ESI) in Wichita, Kansas, decided to invest in its own plasma cutter. “We engineer parts for customers and lead times are important,” says Bill Schnittker, president. “We realized if we had our own high-definition plasma, we could finish parts ourselves and not rely on outside sources.”

ESI installs, engineers and manufacturers custom material handling products. It also serves as a dealer for everything from jib cranes and hoists to storage racks and automated guided vehicle systems.

View Index

Editor-in-Chief

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323, www.ffjournal.net

312/654-2309, Fax: 312/654-2323

mdalexander@ffjournal.net

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Oklahoma, Texas, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@ffjournal.net

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Pennsylvania, South Carolina, South Dakota, Tennessee

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@ffjournal.net

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@ffjournal.net

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@ffjournal.net

Periodicals postage paid at Chicago and additional mailing offices. Postmaster: Send address changes to FFJournal® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Periodicals postage paid at Chicago and additional mailing offices. Postmaster: Send address changes to FFJournal® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.